COVID-19 and lockdown regulations have devastating impact on retail sales over 3 month period...

- Andre Annandale

- Jul 28, 2020

- 2 min read

COVID-19 pandemic and lockdown regulations since 27 March 2020 have had a devastating impact on retail activity.

Stats SA reports that South African retail sales slumped by a record 50.4% in April and 12% in May.

Table 1 - Year-on-year % change in retail trade sales at constant 2015 prices by type of retailer (Source: Stats SA Retail Trade Sales May 2020)

March figures reflects panic buying, especially for food & beverage products (general dealers; food, beverages and tobacco in specialized stores categories) and pharmaceutical & medical goods (pharmaceutical & medical goods, cosmetics and toiletries). The rest of the retail categories did not benefit from panic buying.

Worth taking note that the hardware, paint & glass retailers (typical DIY & Building Material retailers) were already seeing declining trade figures before the COVID-19 pandemic and lockdown regulations. Therefore, the YOY growth of 3% seen in May, highest of all categories, is a welcomed relieve for this category, although not nearly a sufficient recovery for some, to keep their doors open.

If one looks at an overall retail industry performance, the following may be of interest to you. The main contributors to the 12,0% decrease in May, were all ‘other’ retailers category (contributing -6,5 percentage points); retailers in food, beverages and tobacco in specialised stores (contributing -2,2 percentage points); and general dealers (contributing -2,1 percentage points).

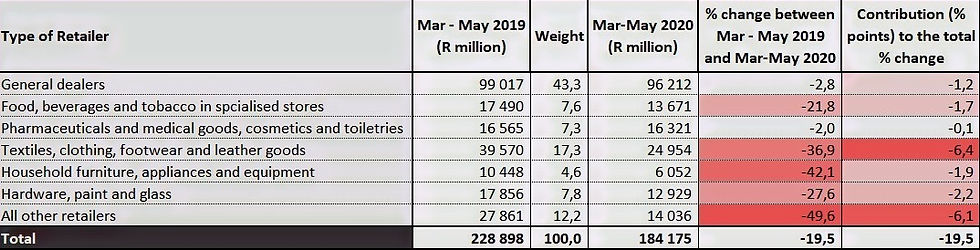

Table 2 - Retail trade sales at constant 2015 prices for the latest three months by type of retailer (Source: Stats SA Retail Trade Sales May 2020)

Retail trade sales decreased by 19,5% in the three months ended May 2020, compared with the three months ended May 2019. It is clear from Table 2 below, that all ‘other’ retailers category has been hardest hit (-49.6%); followed by household furniture, appliances and equipment (-42.1%); textiles, clothing, footwear and leather goods (-36.9%); hardware paint & glass (-27.6%). From an overall contribution to the three month decline of 19.5%, Textiles, clothing, footwear and leather goods was the biggest contributor with -6.4%.

Note - "All other retailers" category consist of retailers selling books, stationary, jewellery, sport goods, entertainment requisites, second hand goods and repair of household goods and other retail not in stores.

Contact Research Matrix for all your Market Research, Sales Channel Optimization and Feasibility Study needs. Email: andre@researchmatrix.co.za

Comments